Kirin Holdings TOB for Kyowa Hakko successful

New Kyowa Hakko Kirin KK to start on October 1, 2008

Tokyo - Kirin Holding KK announced on Friday, December 7, that its tender offer for Kyowa Hakko Kogyo KK shares running from October 31 to December 6, 2007 was successfully closed. More than 273 million common Kyowa Hakko shares were tendered what should give Kirin HD the necessary 50.1% control over Kyowa Hakko.

At the next step, Kyowa Hakko via a stock swap will integrate the current Kirin Pharma KK, what will give an unobstructed way for Kirin HD to make Kyowa Hakko a subsidiary.

The current spate of acquisitions is expected to require some 500 billion Yen from Kirin HD, which currently is reported to have cash reserves standing at about 150 billion Yen.

More details on the Kirin Pharma and Kyowa Hakko merger below

Outlining the future growth

Tokyo, October 29, 2007 - The President & CEO of Kirin Holdings Kazuyasu Kato (pictured at left) delivered a keynote presentation at the The 9th Nikkei Global Management Forum held in Tokyo on October 29-30, 2007.

Jointly organized by Nikkei Inc., the International Institute for Management Development (IMD) and the Walter H. Shorenstein Asia-Pacific Research Center at Stanford University, the conference focuses on ideas to help achieve further corporate growth.

Notably, the presentation of Kirin Chairman was entitled "Leveraging M&A Opportunities for Quantum Leap" and delivered during a period of rapid growth for his organization. Just within weeks after the presentation, Kirin HD made large foreign acquisitions in food and beverage area, as the announced target is to have sales of 3 trillion Yen by 2015.

Chronology of new trend convergence

2001-02 - The President of Kirin Pharma KK Katsuhiko Asano (pictured at left) started what he describes now as "I've been talking with Matsuda for five or six years with the conviction that combining our technologies will be effective going forward".

Spring 2007 -

Kirin Biru and Kyowa Hakko Kogyo (HQ pictured at left) signed a confidentiality agreement to enter into serious integration discussion.

Kirin Biru and Kyowa Hakko Kogyo (HQ pictured at left) signed a confidentiality agreement to enter into serious integration discussion. July 1, 2007 - The former "Pharmaceutical Division" of Kirin Biru KK was converted into Kirin Pharma KK

, a wholly-owned subsidiary of the newly established Kirin Holdings KK.

, a wholly-owned subsidiary of the newly established Kirin Holdings KK.The newly-established Kirin Pharma KK

made a fresh start as 12th largest Japanese pharma company, its blue-glass designer HQ building unconventionally located in the entertainment district of Harajuku in Tokyo.

made a fresh start as 12th largest Japanese pharma company, its blue-glass designer HQ building unconventionally located in the entertainment district of Harajuku in Tokyo.July 19, 2007 - Kirin Pharma, Terumo and Kirin Holdings Company, Limited (President and CEO, Kazuyasu Kato; hereinafter, "Kirin Holdings"), the holding company of the Kirin Group, reached the following arrangement for a mutual investment. Kirin Pharma in the market acquires Terumo shares worth 10 billion yen, and Terumo also in the market acquires Kirin Holdings shares worth 10 billion yen, both by December 28th, 2007. Terumo acquires Kirin Holdings shares because Kirin Pharma's shares are not publicly traded.

September 22, 2007 - JapanBridge, Inc., a specialty pharmaceutical company with operations in Tokyo founded in 2006 by MPM Capital and Itochu Corporation, announced today that it has entered into a strategic alliance with Kyowa Hakko Kogyo Co., Ltd., a major Japanese pharmaceutical company, to collaborate on the commercialization of oncology and oncology supportive care assets in Japan. Although Kyowa Hakko poured 15% of the capital in the new venture in JapanBridge, the connection was not mentioned in any aspect in the merger announcements.

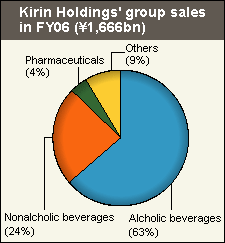

October 19, 2007 - In the early hours of the day (02:30 am) the online edition of Nihon Keizai Shimbun reported Kirin in talks to acquire Kyowa Hakko in order to lift the negligible numbers

of

its pharma sales.

of

its pharma sales. The same morning Kyowa Hakko promptly denied the announcements with a press release: Comments on today's media on report: There were announcements today that Kirin Holdings KK is in negotiation to purchase our company made by the news organizations, including making a TOB (take-over bid) for our stocks. In fact there is nothing decided to warrant a report, though the business tie-ups always have been examined as other various possibilities as well.

Regardless of denial, the shares of both companies reached their daily limit at the Tokyo Stock Exchange.

October 22, 2007 - At a press conference

and

by numerous press releases it was announced that the three parties (their presidents

pictured from left to right: Kirin Pharma, Kirin Holdings and Kyowa Hakko) have reached a broad agreement for integration in several steps until October 2008: Kirin is to buy Kyowa Hakko shares through a tender offer without taking a majority stake, but reaching 50.1%. Later, Kirin's pharmaceutical subsidiary, Kirin Pharma KK, is to merge with Kyowa Hakko Kogyo KK, with Kyowa Hakko to be the surviving company. Kirin will have a majority stake in the new merged firm, which will become Kirin's consolidated subsidiary under the tentative name Kyowa Hakko Kirin KK. The value of the takeover is estimated to about 300 billion Yen. As the first step toward full integration, Kirin will acquire 27.95% of Kyowa Hakko through a takeover bid. Then, in April 2008, Kyowa Hakko will take over Kirin subsidiary Kirin Pharma Co. through a stock swap. With this, Kirin will hold 50.1% of Kyowa Hakko and turn it into a consolidated subsidiary. Kyowa Hakko and Kirin Pharma will merge in October 2008.

and

by numerous press releases it was announced that the three parties (their presidents

pictured from left to right: Kirin Pharma, Kirin Holdings and Kyowa Hakko) have reached a broad agreement for integration in several steps until October 2008: Kirin is to buy Kyowa Hakko shares through a tender offer without taking a majority stake, but reaching 50.1%. Later, Kirin's pharmaceutical subsidiary, Kirin Pharma KK, is to merge with Kyowa Hakko Kogyo KK, with Kyowa Hakko to be the surviving company. Kirin will have a majority stake in the new merged firm, which will become Kirin's consolidated subsidiary under the tentative name Kyowa Hakko Kirin KK. The value of the takeover is estimated to about 300 billion Yen. As the first step toward full integration, Kirin will acquire 27.95% of Kyowa Hakko through a takeover bid. Then, in April 2008, Kyowa Hakko will take over Kirin subsidiary Kirin Pharma Co. through a stock swap. With this, Kirin will hold 50.1% of Kyowa Hakko and turn it into a consolidated subsidiary. Kyowa Hakko and Kirin Pharma will merge in October 2008.

October 22, 2007 - Accidentally or not, at the same day when the merger was officially announced, Kirin Pharma ran a highly profile job recruiting advertisement featuring a young employee from its Clinical Development Department and a popular TV personality.

The main purpose of the dialog was to explain in coloquial terms what the job of the Medical repersenatyive is and all opportunities stemming from working in Kirin Pharma.

At present the company employs some 1,200 staff in totally 15 locations around the country.

2022 - It is well publicized that a notable part of the agreement is that Kirin will not change its 50.1% stake in the new firm over the decade after October 2008, indicating that a long "fermentation" period will be necessary before the technologies the firms bring together bear commercial fruit. While the merger is clearly in seeking a synergy in antibody technology know-how, it is also cautionary orchestrated merger. "We'll combine our talents in biotechnology to become a world-class, R&D-oriented life sciences firm," said Kyowa Hakko President Yuzuru Matsuda

at the press conference, before presenting his blueprint for the merged firm from the standpoint of the researcher he used to be. In one aspect Kirin is unique

among its Japanese peers - Asahi Breweries and Suntory have already sold off their pharmaceutical businesses because of the huge amount of investment required for research and development and the lack of synergy with other parts of their operations.

Kirin Holding company stresses the belief that the company "needs discontinuous growth" as the term is uses to mean Kirin requires growth strategies based on a new perspective, rather than merely seeking to progress as it did in the past. The group now aims for 3 trillion yen in consolidated sales in the year through December 2015 by focusing on alcoholic beverages, soft drinks and pharmaceuticals.

at the press conference, before presenting his blueprint for the merged firm from the standpoint of the researcher he used to be. In one aspect Kirin is unique

among its Japanese peers - Asahi Breweries and Suntory have already sold off their pharmaceutical businesses because of the huge amount of investment required for research and development and the lack of synergy with other parts of their operations.

Kirin Holding company stresses the belief that the company "needs discontinuous growth" as the term is uses to mean Kirin requires growth strategies based on a new perspective, rather than merely seeking to progress as it did in the past. The group now aims for 3 trillion yen in consolidated sales in the year through December 2015 by focusing on alcoholic beverages, soft drinks and pharmaceuticals. Kyowa Hakko

has

attracted industry attention for its Potelligent and Complegent technologies, which significantly enhance the efficacy of antibody products. Potelligent technology enhances the effect of drugs by up to 100 times by extracting a specific sugar from the center of an antibody, while Complegent technology does so by about 10 times by integrating two kinds of antibodies. In combination, they can make drugs up to 1,000 times more effective. It has licensed the technology to nine companies including Takeda Pharmaceutical Co., Biogen Idec Inc. and Genentech Inc. Kirin's strength lies is in what it calls "humanization" technology, which helps prevent the human body from rejecting antibody drugs. In partnership with U.S. biotech firm Medarex Inc., it has developed a genetically altered mouse that produces "humanized" antibodies, and it has already signed contracts to license the technology to several firms in Japan and abroad. By combining Kyowa Hakko's technology for enhancing the effects of antibody drugs with Kirin's in developing antibodies with fewer side effects, the firms will work to develop antibody products for cancer, kidney disease and immunodeficiency. Their strategy is to concentrate on their strengths and move forward as a maker of specialty pharmaceuticals.

has

attracted industry attention for its Potelligent and Complegent technologies, which significantly enhance the efficacy of antibody products. Potelligent technology enhances the effect of drugs by up to 100 times by extracting a specific sugar from the center of an antibody, while Complegent technology does so by about 10 times by integrating two kinds of antibodies. In combination, they can make drugs up to 1,000 times more effective. It has licensed the technology to nine companies including Takeda Pharmaceutical Co., Biogen Idec Inc. and Genentech Inc. Kirin's strength lies is in what it calls "humanization" technology, which helps prevent the human body from rejecting antibody drugs. In partnership with U.S. biotech firm Medarex Inc., it has developed a genetically altered mouse that produces "humanized" antibodies, and it has already signed contracts to license the technology to several firms in Japan and abroad. By combining Kyowa Hakko's technology for enhancing the effects of antibody drugs with Kirin's in developing antibodies with fewer side effects, the firms will work to develop antibody products for cancer, kidney disease and immunodeficiency. Their strategy is to concentrate on their strengths and move forward as a maker of specialty pharmaceuticals.

Considerable emphasis has been put on the synergy in antibody technology and production what seems to be sought by both partners and pointed out by several security analysts. When confronted in an interview with Nihon Keizai, Dr. Matsuda provided the following comments:

Q: Can you elaborate on Kyowa Hakko's decision to join the Kirin group? A: We could have gone it alone, but we can speed up our new drug development by integrating with Kirin Pharma Co. I believe we will be able to create a company that is internationally competitive in the new field of antibody-based pharmaceutical products.

Q: But of the combined 21 drug items under development at both Kirin and Kyowa Hakko, only three are antibody drugs. A: Both Kyowa Hakko and Kirin have several antibody drug candidates that have not entered the clinical testing phase yet. The business integration plan also aims to speed up R&D so that there is a constant stream of candidate drugs ready to begin clinical testing. At major domestic drug companies, R&D costs account for less than 20% of sales. While we are much smaller in size, we want to clarify our emphasis on R&D by raising the percentage to around 20%.

The merger procedure has been already set in motion, but a number of questions still stand such as what would happened with the remaining 63% non-pharmaceutical business of Kyowa Hakko and of course the key one: is the outside the industry savior a new trend in convergence for the (Japanese) pharma industry?Data sourced from companies press releases and general media; additional content by JKS staff